Understanding the Data

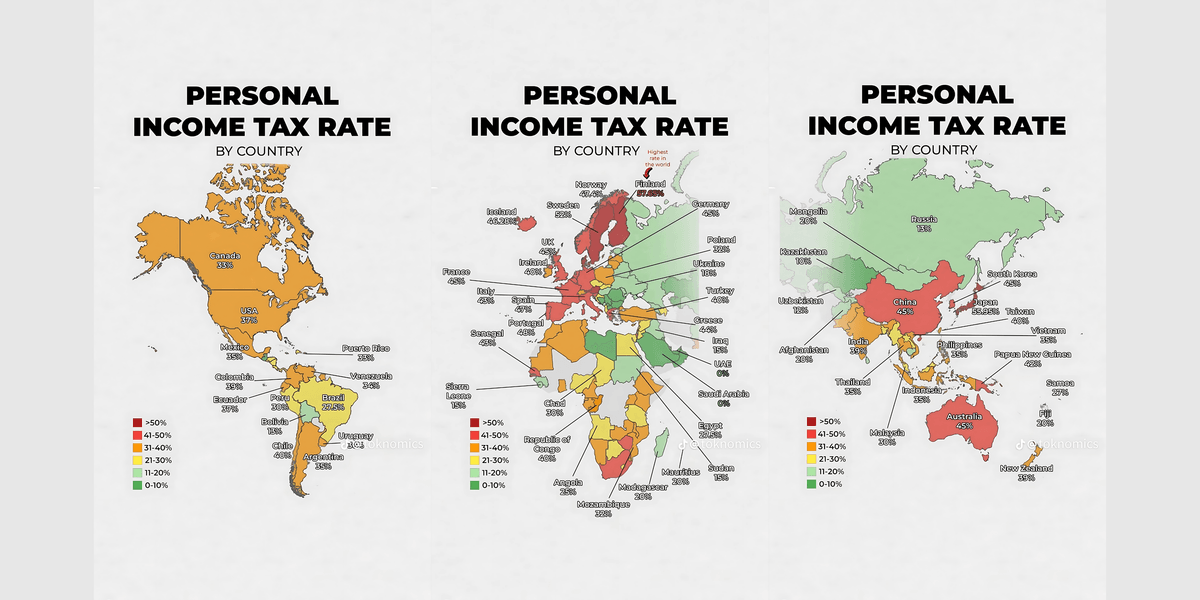

A recent heatmap showcases personal income tax rates across regions. Here's a quick overview from low-tax zones to high-tier areas:

- Green (0–10%): Examples include the United Arab Emirates and Saudi Arabia—signifiers of no personal income tax.

- Light Green (11–20%): Countries like Russia (~13%) and Uruguay (~30%) fall here.

- Yellow to Orange (21–40%): Brazil (~27.5%), India (~39%), and the Philippines (~35%) reflect moderate taxation.

- Red to Dark Red (>40%): Highlighted nations include France (~45%), Australia (~45%), South Korea (~45%), and Finland (~55.95%).

⭐ Notable Tax Realities Around the World

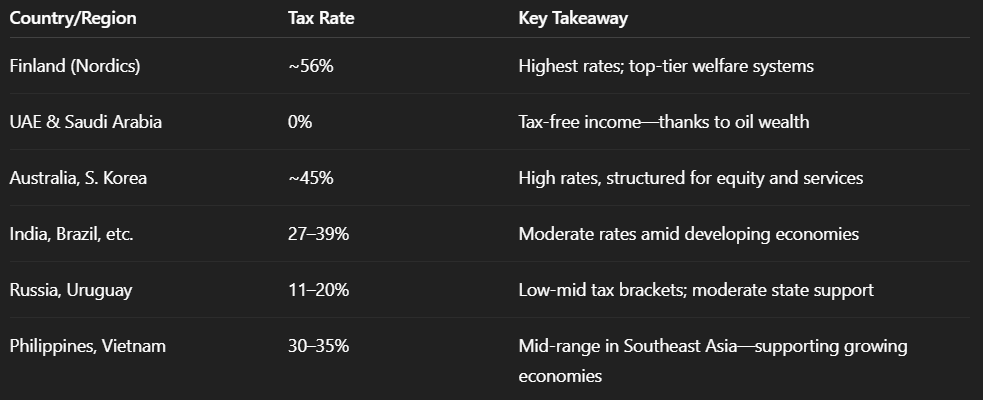

1. Finland – The Crown Jewel of Taxation (~56%)

Topping the global charts, Finland’s highest tax bracket approaches 56%—arguably the world’s steepest. This rate underscores the Nordic model of comprehensive social welfare, but it also means more than half of high earners’ income goes to the state.

2. Zero Taxes in the Gulf

The United Arab Emirates and Saudi Arabia, marked in green, impose no personal income tax—a rarity globally. Their reliance on oil revenues allows for this attractive fiscal environment.

3. High Taxes Beyond Europe

Australia (~45%) and South Korea (~45%) feature among the highest non-European tax rates. Both countries maintain robust social programs and acknowledge growing income inequality, which tax policy aims to counterbalance.

4. The Golden Middle

Countries like India (39%) and Brazil (27.5%) represent a balanced middle-ground. These rates support government services while offering some tax relief to encourage personal earnings and growth.

What Do These Rates Mean for You?

💡 Pro Tip: Stretch Your Earnings with KXZ Store

If you're living in a high-tax country, every penny counts! That’s why savvy users are turning to KXZ Store to save on game top-ups, gift cards, and digital content at unbeatable prices. Whether you're in Japan, the U.S., or India—KXZ helps you make the most of your hard-earned money with legit, low-cost deals that work worldwide.

🎮 Get more game time, without more tax: Visit KXZ Store today.

Final Thoughts

The global landscape of personal income tax is as diverse as cultures and economies themselves. Whether implementing progressive social programs or attracting foreign talent with low taxes, each country strikes a unique fiscal balance.

Let me know if you'd like a deeper dive into tax brackets, effective tax rates, or how tax affects personal investment across different countries—happy to explore further!