📌 Key Highlights

- Graham Krizek, CEO of Voltage, believes 5% or more of global stablecoin volume will move through the Lightning Network by 2028.

- Current daily stablecoin trading volume is around $180 billion. At 5%, that's nearly $9 billion per day potentially flowing through Lightning.

- Though stablecoin activity on Lightning is currently minimal, adoption could explode as Tether, Circle, and other major issuers roll out Lightning-native integrations in late 2025.

⚡ What is the Lightning Network?

The Lightning Network (LN) is a second-layer protocol built on top of Bitcoin, enabling fast, scalable, and low-fee transactions. It achieves this by establishing peer-to-peer payment channels off-chain, significantly improving transaction throughput and reducing costs.

As a payment rail, Lightning is particularly well-suited for microtransactions, international remittances, and everyday crypto payments — and is now being considered for use with stablecoins like USDT and USDC.

🚀 Why 5% Is a Big Deal — And a Realistic Target

According to Krizek, Lightning has all the ingredients to become a primary infrastructure for stablecoin payments:

- Tether (USDT) Comes to Lightning: Tether has already announced plans to bring USDT natively to Bitcoin using Lightning. This could serve as the catalyst for widespread use.

- Taproot Assets Upgrade: Lightning Labs' release of Taproot Assets v0.6 transforms Lightning into a decentralized FX layer, perfect for stablecoins.

- Global Payments Potential: Lightning provides instant, cheap, and censorship-resistant payment capabilities — a perfect match for stablecoin use cases.

- Regulatory Momentum: With stablecoin legislation like the GENIUS Act gaining traction in the U.S., legal clarity could supercharge adoption.

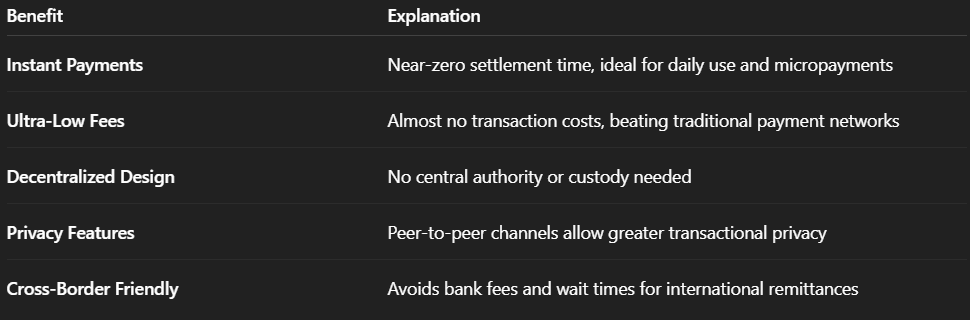

💡 Benefits of Using Lightning for Stablecoins

🧱 Challenges to Overcome

- Limited Current Adoption: Lightning currently handles very little stablecoin volume.

- Liquidity Routing: Scaling stablecoin liquidity across Lightning channels remains a technical hurdle.

- UX Complexity: Wallets and interfaces still require streamlining for mass adoption.

- Stablecoin Issuer Participation: Widespread integration from USDT/USDC issuers is still pending.

- Regulatory Caution: Legal ambiguity around stablecoins may limit how fast institutions can move.

🌍 Real-World Use Cases

- Cross-Border Remittances: Replace SWIFT or remittance services with instant, low-fee payments.

- E-commerce Payments: Offer instant settlement without high credit card fees or chargebacks.

- Gig Economy & Payroll: Pay freelancers and global contractors instantly in USDT over LN.

- Gaming & Creator Economy: Enable tipping and streaming micropayments.

🧭 Final Thoughts

Graham Krizek's forecast that Lightning Network could capture 5% of stablecoin volume by 2028 reflects a credible and exciting future for Bitcoin's second-layer scaling tech.

It’s more than a dream — it’s a global shift in how value flows, with Lightning acting as the invisible rail beneath a new era of digital payments.

As stablecoins expand and Layer-2 infrastructure matures, the fusion of Bitcoin’s security with Lightning’s speed may soon make it the dominant pathway for trillions in annual stablecoin flows.

🔥 Power Your Crypto Journey with KXZ

Looking to boost your crypto portfolio effortlessly? Head over to the KXZ Store and grab a Binance Gift Card in USDT or USDC. It’s the fastest, most secure way to send or spend stablecoins — perfect for gifting, investing, or topping up your Binance account instantly. Whether you're a trader or a hodler, KXZ makes it seamless to stay crypto-ready.